Automation in Banking & Financial Services India

Amit Khandelwal, SVP & Head IT, Visionet Systems Pvt. Ltd. | Wednesday, 22 April 2020, 13:28 IST

The digital revolution and proliferation of latest technologies have taken the world by storm. The rapid adoption of these emerging technologies confirms that the age of automation is upon us. The financial service sector, typically perceived as a conservative industry, has undergone tremendous evolution over the last few years. Being the kind of industry, which is dominated by labour-intensive processes, the banking industry had to lead in welcoming automation solutions.

AI automation in the banking industry began with the automation of a few traditional and simple day-to-day tasks like data entries, cash deposit, updating passbook and salary uploads etc. Gradually, the sector has adopted technology so well that now, it has optimised almost every BFSI process from loan processing, KYC, relationship management between customers and bank to risk assessment, loans and even sales.

To make the segment advanced, updated, hassle-free and fast for the service provider as well as the consumer, the BFSI sector is vastly focusing on optimising processes and improving the overall efficiency of business and operations.

There are mixed results so far with some pilots are successful and some don’t prove to be effective for a longer-term. Many banks today have set up tons of bots (Automation software for repetitive tasks), however, results are minimal in terms of efficiency and effectiveness. Some institutions have launched numerous tactical pilots without a long-term plan, resulting in clarity issues, confusion and scale-up challenges. Other banks have trained developers but have been unable to move solutions into production. One of the best outcomes so far is that everyone is attempting the automation opportunities to find out lack of capabilities required to move the work forward, its way behind the transformation, which the banks should have comprehensively.

However, the future is certainly very bright due to the following:

- The technology is rapidly maturing, and both banks and vendors (System Integrators, Product companies, and other vendors) are developing domain expertise.

- Banks are learning ways to effectively manage handoffs between man and machine (Remember 10-30% of the work will be automated in the next couple of years, depending on the bank's maturity)

- All senior leaders have a PoV on automation as where typical process re-engineering is needed in favour of automation. It may require completely new ways of working.

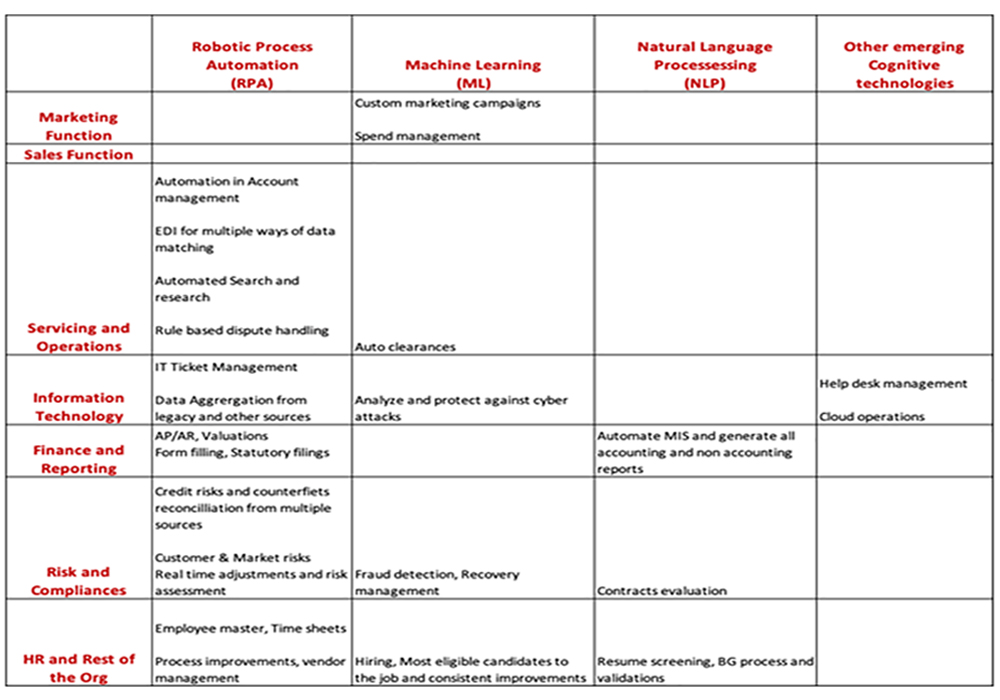

These technological advancements are undoubtedly helping banks to thrive in the ever-changing environment. Here is a summary

Businesses investing in these technologies will certainly be getting benefitted and will see tremendous results in the following areas:

- Improved Customer Experience: A dramatic speed of decision making, elimination of wait time and comprehensive transaction tracking provided by automation, promises better customer relations. Financial service providers are now using chatbots to respond to common queries of customers and automatically extracting information from digital documents, doing away with the need of a customer entering a brick-and-mortar location now and then.

- Risk Management and Fraud Detection: Now-a-days banks can offer customised products to customers by doing a risk assessment and eliminating human errors, replacing manually handled models. Additionally, banks are continuously increasing the accuracy of credit card fraud detection and anti-money laundering (AML) by deploying automated fraud anomaly detection programme.

- Improved Efficiency: Banking operations in terms of processing transactions are now more efficient than ever. Customers, experience fast transactions with reduced risk of human error, for instance, fast and efficient cash deposits and withdrawals using ATMs.

- Increased Human Productivity: Automation of banking, processes have helped increase the productivity of bank employees by eliminating tedious, repetitive and cumbersome tasks such as paperwork associated with various bank (and related institutions) processes.

- Cost-Effectiveness: Automation in the BFSI sector has helped in reducing costs involved in hiring staff, training employees and paying for other physical office overhead expenses. The need to hire multiple employees for several duties has been done away with, as the duties of multiple employees can now be performed by a single automation process. Strong payment systems enabled by e-commerce have also helped in reduced travelling cost for customers.

- Enhanced Flexibility: Automation has enabled banks to adjust instantly to changing banking conditions, globally, largely because automated processes have given them larger connectivity by maximising their reach, thus, enabling them to respond to any number of customers with various demands, doing away with the location barriers.

- Real-Time Data Assessment and Processing: The technological tools have enabled banks to assess and process real-time data which was never possible in human-intensive business culture.

- Transparency: The rise of digital has led to transparency in banking processes and functions. It is a fact that more the human intervention in any business activity or function less is the transparency whereas automation of such functions in any industry brings transparency.

The Future of Automation in Banking and Financial Services

The future of Banking and Finance is automation. Digital transformation will continue to increase traction in the sector with the support of government initiatives in and around payments, for instance, demonetisation, the rise of e-wallets and other modes of payments, easier loans, faster assessments and approvals, easier KYC etc.

We expect most leading and IT savvy banks (Technology banks) will be taking firm steps of linking automation with prediction and hence opening up new ways of thinking for future growth & customer experiences. There will be much more experimentation and savvy SI partners working closely with these banks on these iterations will be great pillars to the banks for their success.